Which of the Following Actions Can Negatively Impact Your Credit Score

Ultimate Guide to Rebuilding Your Credit

The following guide is presented for informational purposes simply and is non intended as credit repair.

If you have poor credit, you're non alone. Information technology turns out that twenty percent of Americans accept a FICO score of 600, which is considered to exist subprime. While yous may exist suffering in good visitor, not having a solid score can hurt your chances in getting the best terms and rates with loans and credit cards, can limit your options for cell phone providers, and can fifty-fifty hurt your chances of renting an flat.

Hither's the good news: with a bit of knowledge, delivery, and dedication, you can dig yourself out of having bad credit.

In our comprehensive guide, nosotros'll become over the basics of a credit score, what hurts your credit, debunk some common myths and misconceptions, and offering pointers on how to become about rebuilding credit.

What's in a Credit Score?

While FICO® and VantageScore® are the ii most common credit scoring models for consumers, to keep things simple, in this guide we'll refer to the FICO score.

The range for FICO credit scores is 300 to 850.

And so how does your current score measure up? Hither are the credit score categories:

Excellent: 800 to 850

Very Good: 740 to 799

Adept: 670 to 739

Off-white: 650 to 699

Poor: 550 to 649

Bad: 550 and below

And so what's in a credit score? There are five main parts, or factors that make upwardly a FICO credit score:

Payment history: 35 percent

Your payment history of both revolving credit, such as credit cards, and installment credit, such every bit an auto loan or a mortgage, bear witness up on your credit written report.

Amounts owed: 30 percent

Basically the total corporeality of debt you owe.

Length of credit history: xv percent

How long all your credit accounts have been open up.

New credit: 10 percent

How many inquiries for credit you've fabricated in a period of time. Typically if you employ to open several credit cards within a few weeks, it's a sign to lenders that you may be experiencing financial troubles.

Nonetheless, if you are applying for a type of installment credit, multiple inquiries within a certain time frame (typically within a few weeks) count as a single enquiry.

Credit mix: 10 percent

This is your mix of loans, credit card accounts, retail accounts, and accounts with finance companies.

Common Reasons Why Your Score Was Dinged

There are myriad reasons why your credit score may have been dinged:

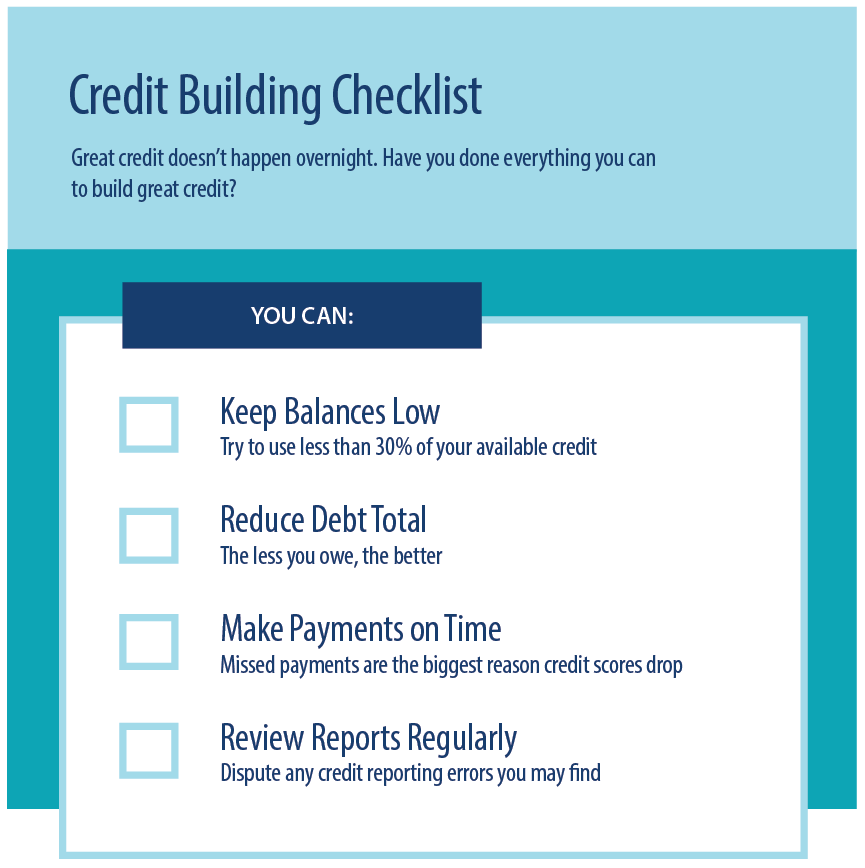

High amounts owed

In turn, your credit utilization ratio, or total outstanding balance on all your cards confronting the full number of credit cards, also affects your score. The lower your credit utilization ratio, the improve. It's generally recommended to keep your credit utilization ratio below 30 percent.

You tin employ this calculator to figure out how much of your available credit you lot withal accept available.

Late or missed payments

For the FICO credit scoring model, your payment history makes up 35 percent, which is the lion'south share of your credit score. Late payments usually stay on your credit report for seven years.

Errors on your credit study

Not all errors on your credit written report negatively affect your score. For instance, typos on your personal data and previous addresses won't ding your score. However, mistakenly reported late payments will touch your score.

Opening new credit accounts in a curt amount of time

Opening a agglomeration of new accounts in a short catamenia of time is indicative that y'all may be financially stressed. Therefore, information technology could negatively touch your credit. However, a number of difficult pulls within a specified fourth dimension period is okay. That's considering it indicates you are applying for new credit.

Myths Nigh Credit Scores

What y'all don't know can hurt yous. At that place are common myths that could cause you to make moves that actually harm your credit:

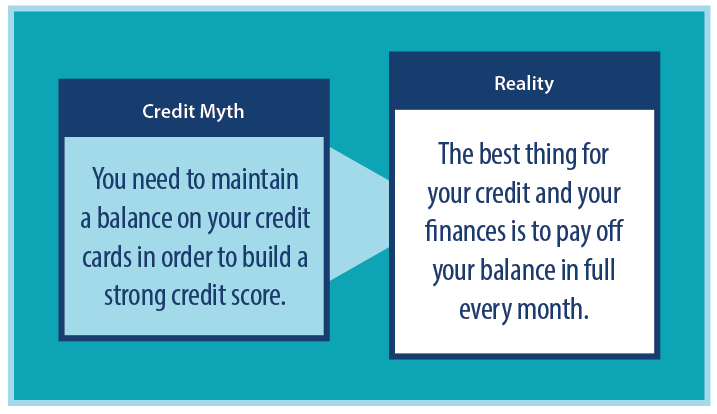

"Y'all need to go along a residue to maintain a good score"

While your credit utilization ratio does affect your credit score, you do not need to maintain a residuum whatever to keep a solid score.

Keeping a residual will but cost you more in the long run, considering you'll be paying more in interest. Ideally, you would similar to pay off your rest in full each month. It'll keep your credit score in tip-summit shape.

"At that place is only 1 credit score that all lenders look at"

According to the same NerdWallet survey, most people have many credit scores. These scores may differ based on the type of information factored in to calculate the score. The scoring model and provider the lender is looking at depends on what you're applying credit for. For case, at that place are credit scores specific to auto loans and mortgages.

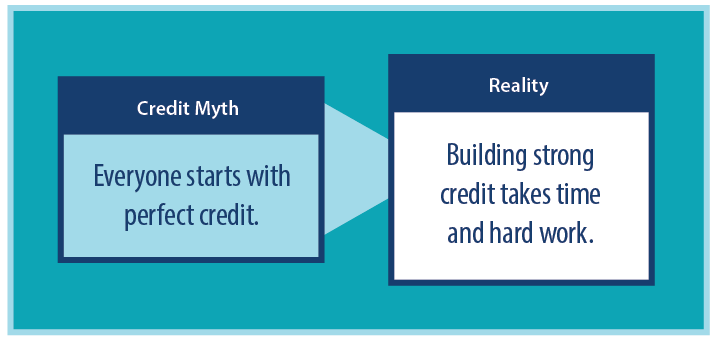

"You get-go with perfect credit"

Co-ordinate to a NerdWallet survey, eleven percentage of Americans think we commencement with a perfect credit score. In fact, while you don't start at goose egg, y'all do have to build your credit over time. So if you don't have a long credit history, you'll need to work at boosting your credit.

"Every fourth dimension your credit report is pulled, your credit score takes a dip"

When your credit report is pulled, it's considered either a "soft" pull or a "hard" pull. A hard pull is when y'all're applying for a line of credit or loan, and the lender needs to check your credit report beforehand.

Nonetheless, if it'due south a "soft" pull, such as when y'all check your own credit, a potential employer reviews your credit, or when a lender sends you a "pre-approved" loan, they may check your credit before extending an offer. In any of these cases, your credit score will not be affected.

How to Rebuild Your Credit Score

At present, on to the good stuff. Here'southward how yous can go near rebuilding your credit:

Order a Credit Report

You can guild 1 a twelvemonth from each of the 3 major credit bureaus—Experian, Equifax, and TransUnion. At that place's only one site that is truly gratuitous: AnnualCreditReport.com.

Considering you tin order i from each credit agency a year, to make sure your credit is accurate and upwardly to engagement, you can stagger and order i every four months.

Beware of sites that claim you tin gild a free credit report. Oft they they may charge you lot an annual fee.

While the credit report is costless, if you lot want to check your credit score, there may be an additional cost. Nowadays many money direction apps, credit cards, and credit monitoring sites offering consumer credit scores complimentary of charge. Withal, their scoring system may be unlike than the FICO® or VantageScore®, so your credit score may exist slightly dissimilar than that of a credit agency.

Chase for Errors

Certain errors (i.e., written report of missed or tardily payments) may negatively affect your credit score. If that's the case, y'all'll want to reach out to the credit bureaus and file a dispute. To file a dispute, connect straight with each credit bureau:

- Experian: experian.com/disputes

- TransUnion: transunion.com/credit-disputes/dispute-your-credit

- Equifax: equifax.com/personal/disputes

The credit bureaus generally have xxx days to investigate a dispute.

Stop Doing What Got You lot in the Situation

Pinpoint what information technology is that damaged your credit, and stop doing information technology, explains credit menu expert John Ulzheimer, formerly of FICO and Equifax. For case, if yous take a high balance on your cards, temporarily put a freeze on a few of them. Or run into if you can do a "cash-only" spending plan, or stick to using your debit card for purchases. If tardily or missed payments is what dinged your credit, make certain yous pay on fourth dimension.

Make On-Time Payments

Because payment history makes 35 per centum of your credit score, it's in your best interest to brand the minimum payments on your debts. If you can, fix your payments to go out automatically so you lot don't miss a beat.

If it might be helpful, attain out to your lenders to see if they can change your payment due date so that it coincides with your paydays, or and so y'all aren't paying all your bills at once.

Want to make killer moves on paying off your debts? Aim to make two payments a month, or fifty-fifty weekly.

Proceed Your Debt Low

As credit utilization ratio makes up the "amounts owed" portion of your credit score, you'll desire to proceed your credit utilization as low as possible. Credit utilization is your total outstanding balance against the spending limit on all your cards. For instance, if you accept a full of $4,000 and your full credit card limit is $forty,000, then your credit utilization is 10 per centum.

Stick to Your Repayment Programme

Sit down and effigy out your full debts, including the lender, fees, and interest rates. List them in social club of interest rates. And so, effigy out a debt payoff method that best suits you.

"Paying on fourth dimension isn't terribly difficult, but paying down debt tin can be a existent challenge, especially if your credit menu payments are already straining your budget," explains consumer credit practiced Kimberly Rotter. "My number i suggestion would exist to pick a payoff strategy and commit to it," says Rotter.

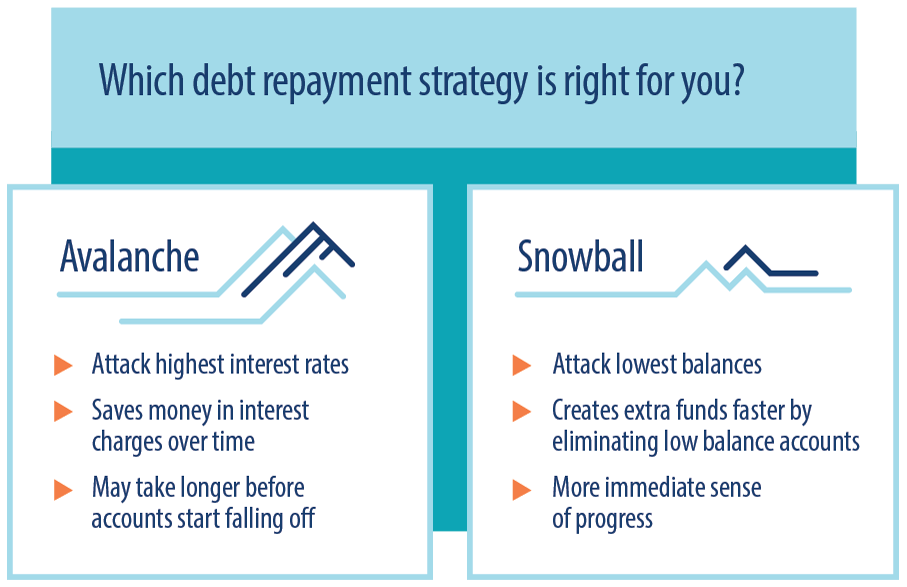

There are two pop types of debt payoff strategies:

Avalanche Method

With the avalanche method, you focus on your debts with the highest involvement rates beginning. Essentially, you pay the minimum on all your debts, then put everything left over toward that highest involvement rate account. When you are done paying off the first debt, y'all can motility on to the adjacent highest interest rate. Considering you are knocking out the debt with the highest involvement rates, this method mostly helps y'all relieve the well-nigh money.

Snowball Method

Conversely, the snowball method is when y'all prioritize the debt with the everyman balance first. Once that's paid off, you lot move on to the debt with the adjacent lowest balance. While you may save more on the involvement with the avalanche method, some people opt for this because as y'all'll be able to knock off individual debts sooner, which can help keep you motivated.

Prioritize Your Debts

While you lot may exist juggling multiple financial priorities—paying your basic living expenses, saving for an emergency fund, retirement, a house, or for your children's college education—keep your debt meridian of heed.

Afterward you come up with a repayment plan, make sure you adhere to it. If your current fiscal state of affairs should change, make necessary tweaks.

Start Minor

If you are struggling financially to go on up with your payments, merely make the minimum payments at the very least. If you can, pay a little extra each month.

Exercise One Thing a 24-hour interval to Meliorate Your Finances

Rebuilding your credit takes commitment, dedication, and persistence. Rotter suggests doing ane small thing each day to improve your credit card score. "Y'all might not think a dollar can make a deviation," explains Rotter, "but if you lot tin can pocket a dollar every day, that's a $30 extra monthly payment toward a bill looming over your head."

Rotter started her ain debt payoff using the barrage strategy with an extra $25 a month. In one case her first pecker was paid off, she added the minimum payment (about $30) and the extra $25 a month to the minimum payment on the next beak. "If you keep paying back more than yous spend every month, eventually you volition come out on the other side."

Increase Your Credit Limit

By increasing your total credit limit, you could lower your credit utilization ratio. For instance, if your total outstanding residuum is at twoscore per centum, increasing your spending limit on a carte du jour or two could bring down your credit utilization to 30 percent.

If yous are upping your credit credit limit, a word of caution: just exist certain not to spend more. That will naught any efforts to boost your credit score. It might aid to fix alerts on your credit cards for transactions over a certain amount, or when you've hit a certain amount.

Exist Patient

It probable took years to impairment your credit then it will take time to rebuild, explains Ulzheimer. "Time certainly is your ally and every bit your negative entries age, they will lose negative value in your credit scores, and eventually they will autumn off of your credit reports."

"Financial health does not come in a week or a month, or sometimes even in a year," adds Rotter. "It'south easy to get burned out on a frugal lifestyle if that's how you're trying to pay down debt. Just remember that you're making a long-term investment in yourself. You'll lower your stress and increase your happiness when y'all learn how to handle credit and finances responsibly."

Many people believe it takes years to rebuild credit. "That'south merely not truthful," says Ulzheimer. "It may have years to turn a credit score of 600 to an 800, but you can certainly enjoy the rising of your score along the way much sooner."

Continue to Check Your Credit

You lot can monitor your progress past checking in on your credit score periodically. Don't forget that yous tin social club upwardly to three credit reports—one from each of the three major credit reporting bureaus—within a 12-month period.

Hopefully by at present you lot feel improve informed and well-equipped to tackle rebuilding your credit. While it may take time to rebuild your credit, with the proper know-know and resources, you'll boost your credit score.

If you accept questions on how to improve your credit score, contact a Money Management International (MMI) to learn more than about understanding your credit written report or overcoming credit carte debt.

mccarthyowery1942.blogspot.com

Source: https://www.moneymanagement.org/budget-guides/rebuild-your-credit

0 Response to "Which of the Following Actions Can Negatively Impact Your Credit Score"

Post a Comment